Financial Aid: Policies & Procedures

The Financial Aid Policy and Procedures page at Campbellsville University outlines important guidelines and requirements for securing and maintaining financial aid. It covers everything from eligibility criteria and application deadlines to the renewal process for scholarships, grants, and loans. This page ensures that students are informed about the necessary steps and expectations to effectively manage their financial aid throughout their academic journey.

Cost of Attendance FAQS Staff Student Employment Tuition & Fees

General Policies:

Financial Aid at Campbellsville University is a cooperative investment in youth and focuses on the student as an individual. The programs are intended to remove the financial barrier from students who are unable to pay, to ease the financial burden for those who are more able to pay, and to manifest a special commitment to disadvantaged students.

At Campbellsville University, the actual amount of the financial aid award is determined primarily by the student's financial need. “Need” is defined as “cost of education minus family contribution.” The type of assistance a student receives is determined by both need and qualification (i.e., academic achievement, character, and future promise).

A student altering his enrollment status from full-time to part-time by dropping classes may be entitled to a refund of tuition. If so, the student may require an adjustment in his Financial Aid package. Business Services determines if the student should receive a tuition refund and notifies the Office of Financial Aid of the need. The Office of Financial Aid then determines if aid must be adjusted according to Federal, State, and institutional regulations. If adjustments are made, the Office of Financial Aid notifies Business Services of the changes.

There will be no partial refunds for dropped classes. Students who drop individual classes before the published “last day to register” will receive a full refund and no grade. Classes dropped after this date will receive a grade and no refund. When a student drops all their classes they have withdrawn and the withdrawal refund policy is applied. Adding a second eight-week course even after dropping a class may result in additional tuition charges.

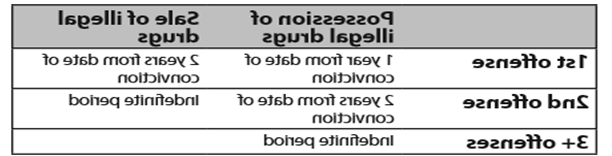

Federal law provides that a student who has been convicted of an offense under any federal or state law involving the possession or sale of a controlled substance during a period of enrollment for which the student was receiving financial aid shall not be eligible to receive any federal or institutional grant, loan, or work assistance during the period beginning on the date of such conviction and ending after the interval specified in the following table.

A student regains eligibility the day after the period of ineligibility ends for a 1st or 2nd offense, or when student successfully completes a qualified drug rehabilitation program that includes passing two unannounced drug tests given by such a program. Further drug convictions will make him ineligible again.

Students denied eligibility for an indefinite period can regain eligibility after completing any of the following options:

- Successfully completing a rehabilitation program, as described below, which includes:

- Having the conviction reversed, set aside, or removed from the student's record so that fewer than two convictions for sale or three convictions for possession remain on the record; or

- Successfully completing two unannounced drug tests which are part of a rehab program (the student does not need to complete the rest of the program).

Campbellsville University's goal to manage cohort default rates is to maintain less than 15 percent for each of the three most recent cohort years. When reaching that goal, we will be allowed to disburse aid in a single disbursement for loans that are originated in a single semester, a single trimester, or a period of four months in length. There will also be an exemption of the 30-day delay of the first disbursement of a loan for first time, first year, undergraduate borrowers.

A contract with Kentucky Higher Education Assistance Authority helps assist with cohort default rate efforts to ensure that our default rate remains lower than 15 percent. The efforts include default prevention where students that are already in our cohort are counseled on their repayment, deferment, and forbearance options. Getting the borrower into successful repayment terms is the main objective in this service.

Campbellsville University desires to remain eligible to participate in the Direct Loan and Federal Pell Grant programs every year and this is determined by consistent rates below 15 percent.

- Fees are non-refundable.

- Tuition, Room, and Meal will be refunded according to the following schedule of adjustments:

Percentage Charge for Tuition:

**Official Date of Withdrawal

| # Weeks in Class Session | 15 | 8 | 5 | 4 | 3 | 2 |

|---|---|---|---|---|---|---|

| Before classes begin | 0% | 0% | 0% | 0% | 0% | 0% |

| During 1st week | 20% | 20% | 20% | 40% | 40% | 80% |

| During 2nd week | 40% | 80% | 80% | 100% | 100% | 100% |

| During 3rd week | 80% | 100% | 100% | 100% | 100% | 100% |

| During 4th week | 80% | 100% | 100% | 100% | 100% | 100% |

| Thereafter | 100% | 100% | 100% | 100% | 100% | 100% |

When a student has financial aid other than student employment and withdraws during the time that a tuition refund is due, the student is eligible to keep the same percentage of aid that they are charged for tuition. The remaining aid is refunded to the financial aid programs.

The pro-rata refund policy and federal refund policy guidelines can be found in the Federal Student Financial Aid Handbook located in the Office of Financial Aid.

**NOTE: The Official Date of Withdrawal is the last day of class attendance. It is Campbellsville University's policy that when a student withdraws he/she must complete an official withdrawal form and return it to the Vice President for Academic Affairs. This MUST be done within seven calendar days of the last day of class attendance. Failure to follow the official withdrawal policy results in a charge of $100 and “F” grades in all courses. Exceptions will be granted only in cases of documented extenuating circumstances.

Professional Judgement is a process a student can apply for when they feel the information reported on the FAFSA no longer accurately reflects their financial situation. If your financial circumstances have changed, there are situations where financial aid professionals can review and update your FAFSA to better reflect a student's situation. These changes may, or may not, impact your financial aid.

Professional Judgement Policy Procedure

What is an SAI?

- SAI stands for Student Aid Index and is the number that helps determine the amount of financial aid a student is eligible to recieve. The Department of Education calculates the SAI from the information on a student's FAFSA. A student's SAI helps financial aid professionals determine how much financial need-based aid the student is eligible to receive. Financial aid that is based on financial need may include - but is not limited to - things like grants, Federal Work-Study, or subsidized loans.

Once your FAFSA form or FAFSA correction has been processed, you can get a copy of your SAR by

- logging in to studentaid.gov using your FSA ID and select the “View or Print your Student Aid Report (SAR)” option near the middle of the “My FAFSA” page or

- contacting the Federal Student Aid Information Center at 1-800-4-FED-AID (1-800-433-3243; TTY for the deaf or hard of hearing 1-800-730-8913) and requesting a copy be sent to you via U.S. mail (allow 10-14 days for delivery).

My SAI is Zero, or a Negative Number

If your SAI is “0” or a negative number, you have already been offered the maximum amount of Federal and State aid.

My SAI is Greater than Zero

If your SAI is greater than “0” please read the information below about the conditions which do/do not qualify for a Professional Judgement. The process is a way for us to ensure you are receiving the maximum amount of aid possible based on the changes in your financial circumstances. If your SAI is greater than zero, and you have experienced these circumstances, please contact the Office of Financial Aid.

The following conditions may be considered, but are not limited to:

- Loss or reduction of income

- Death of spouse or parent that was reported on the FAFSA (23/24)

- Excess medical or dental expenses paid out of pocket

- Parent reported on the FAFSA retired within the last 12 months

- Marital status change for parent or student

The following conditions may not be considered:

- Information on the FAFSA resulted in a 0 Student Aid Index (SAI)

- Loss of overtime or bonus

- Bankruptcy, foreclosures or collection costs associated with outstanding debts

- Consumer debt (credit cards, car payments, loans, etc.)

- Payments on back taxes owed to the IRS

- Lottery or gambling winnings or losses

- One-time income used for non-life essential items (e.g. family vacation)

- When an adjustment to the FAFSA will not produce a low enough SAI to become eligible

for additional subsidized loans, the Federal Pell Grant, or the state CAP and KTG

grant.

- Example: SAI is $50,000 and one of the parents lost their income for 6 months but the financial impact reduced their SAI to $30,000. This would not gain a student any additional financial aid.

The Professional Judgement Process

If the student qualifies to begin the Professional Judgement Process, they will be contacted and be asked to submit the following:

- Professional Judgement application

- A statement explaining the situation and their request for a Professional Judgement

- Sufficient supporting documentation of circumstances

Possible Outcomes from a Professional Judgement

- No change: The change in circumstances did not impact your Student Aid Index (SAI)

- Reduced SAI but no change in financial aid offer: The change in circumstances reduced the SAI but did not change it enough to impact your financial aid eligibility.

- Reduced SAI and adjustments made to federal loans: The change in circumstances reduced the SAI and qualified you for some subsidized loan funding to replace the equivalent unsubsidized loan funding.

- Reduced SAI and adjustments made to state and/or federal grants: The change in circumstances reduced the SAI and qualified you for additional state and/or federal grants.

- Reduced SAI and adjustments made to state and/or federal grants and federal loans: The change in circumstances reduced the SAI and qualified you for additional state and/or federal grants, as well as qualifying for some subsidized loan funding to replace the equivalent unsubsidized loan funding.

Federal regulation require that all students who receive any federal or state financial assistance make measurable academic progress towards a degree or certificate program at Campbellsville University. Progress is determined quantitatively (credit or clock hours earned and time frame) and qualitatively (GPA). Progress is monitored at the conclusion of each term or payment period. Policies do vary between undergraduate programs, graduate programs, and certificate programs.

Notification of Results: Students who are denied or placed on warning will be notified via mail and/or email within 2 weeks of the conclusion of the term or payment period.

How to Regain Eligibility: To regain eligibility, students may take courses at their own expense in subsequent terms or payment period and meet the standards according to the completion rate and GPA as outlined in each policy. Once you have raised the completion rate and/or GPA, students should contact the Financial Aid Office.

Right to Appeal: If there were extenuating circumstances (injury, illness, death of a relative) that

prevented you from meeting the standards of our Satisfactory Academic Progress Policy,

then you have a right to file an appeal with the Committee for Financial Aid Appeals.

In this appeal you must include a personal statement outlining the following items:

1) The reason why you did not meet Satisfactory Academic Progress and 2) What has

changed now that will allow you to make satisfactory academic progress at the next

evaluation. Students should also meet with an advisor to develop an Academic Success

Plan. Also, any documentation that supports the appeal should be attached.

If your appeal is approved, you will be placed on probation for one term, and after

the probationary period, you must be making satisfactory academic progress or successfully

following an academic plan that has been developed for you. You will be notified via

mail or email the results of your appeal.

As a student, you have the following responsibilities:

- To review all information regarding the institution's programs

- To understand and meet the Satisfactory Academic Progress (SAP) policy

- To understand the institution's refund policy procedure

- To adhere to the deadlines for federal financial aid application or reapplication

- To understand and comply with all the forms that you sign and agree to

- To inform the institution if there are any changes in your personal information

- To complete and submit the most accurate information on financial aid forms/applications.

- To submit any additional information requested by the Office of Financial Aid or through KHEAA Verify

- To understand the financial aid process and submit any forms and/or applications in a timely manner

- To stay informed regarding financial aid by checking your student email account.

- If dependent, to keep your parents informed of all the financial aid requirements and deadlines

- To notify the Office of Financial Aid at the point that you are awarded any outside sources of funding

- To understand and comply with the institution's attendance policy

- To understand and comply with the institution's refund and repayment policy

When borrowing Federal Direct Student Loans, it is a student's responsibility to:

- Acknowledge these funds are to be used for educational purposes

- Complete Loan Entrance Counseling, which is a tool to ensure you understand your obligation to repay the loan http://studentaid.gov/app/counselingInstructions.action?counselingType=entrance

- Sign a Master Promissory Note, agreeing to the terms of the loan http://studentaid.gov/mpn/

- Complete the Annual Student Loan Acknowledgment, allowing a student to view and acknowledge aggregate loan amounts each year http://studentaid.gov/app/counselingInstructions.action?counselingType=entrance

- Begin repaying student loans 6 months after graduation, dropping below half-time enrollment, or leaving school

- Always keep personal information updated with lender, including name, address, and school enrollment status

- Establish a plan to complete a degree before exhausting aggregate loan limits

- Make payments on time. You are required to make payments on time even if you don't receive a bill, repayment notice, or a reminder. You must pay the full amount required by your repayment plan, as partial payments do not fulfill your obligation to repay your student loan on time

How a Withdrawal Affects Financial Aid:

Federal regulations require Title IV financial aid funds to be awarded under the assumption that a student will attend the institution for the entire period in which federal assistance was awarded. When a student withdraws from all courses for any reason, including medical withdrawals, he/she may no longer be eligible for the full amount of Title IV funds that he/she was originally scheduled to receive. The return of funds is based upon the premise that students earn their financial aid in proportion to the amount of time in which they are enrolled. A pro-rated schedule is used to determine the amount of federal student aid funds he/she will have earned at the time of the withdrawal. Thus, a student who withdraws in the second week of classes has earned less of his/her financial aid than a student who withdraws in the sixth week. Once 60% of the semester is completed, a student is considered to have earned all of his/her financial aid and will not be required to return any funds.

Federal law requires schools to calculate how much federal financial aid a student has earned if that student:

- Completely withdraws,

- Stops attending before completing the semester, or

- Does not complete all modules (courses which are not scheduled for the entire semester or payment period for which he/she has registered at the time those modules began.)

Based on this calculation, students who receive federal financial aid and do not complete their classes during a semester or term could be responsible for repaying a portion of the aid they received. Students who do not begin attendance must repay all financial aid disbursed for the term.

How the Earned Financial Aid is Calculated:

Students who receive federal financial aid must “earn” the aid they receive by staying enrolled in classes. The amount of federal financial aid assistance the student earns is on a pro-rated basis. Students who withdraw or do not complete all registered classes during the semester may be required to return some of the financial aid they were awarded.

Institutions are required to determine the percentage of Title IV aid ‘'earned” by the student and to return the unearned portion to the appropriate aid programs. Regulations require schools to perform calculations within 30 days from the date the school determines a student's complete withdrawal. The school must return the funds within 45 days of the calculation. The R2T4 calculation process and return of funds is completed by the Financial Aid Office.

For example, if a student completes 20 percent of the payment period, they earn 20 percent of the aid they were originally scheduled to receive. This means that 80 percent of the scheduled awards remain “unearned” and must be returned to the federal government. After 60% of the semester is completed, a student is considered to have earned all of his/her financial aid and will not be required to return any federal funds.

The following formula is used to determine the percentage of unearned aid that has to be returned to the federal government:

- The percent earned is equal to the number of calendar days completed up to the withdrawal date, divided by the total calendar days in the payment period (less any scheduled breaks that are at least 5 days long).

- The payment period for most students is the entire semester. However, for students enrolled in modules (courses which are not scheduled for the entire semester or term), the payment period only includes those days for the module(s) in which the student is registered.

- The percent unearned is equal to 100 percent minus the percent earned.

For students enrolled in modules:

A student is considered withdrawn if he/she does not complete all of the days in the payment period that the student was scheduled to complete. The University will track enrollment in each module (a group of courses in a program that do not span the entire length of the payment period combined to form a term, for example, courses online and at regional centers and summer sessions) to determine if a student began enrollment in all scheduled courses. If a student officially drops courses in a later module while still attending a current module, he/she is not considered as withdrawn based on not attending the later module. However, a recalculation of aid based on a change in enrollment status may still be required.

Students who provide written confirmation to the Financial Aid Office at the time of ceasing attendance that they plan to attend another course later in the same payment period are not considered to have withdrawn from the term. If the student does not provide written confirmation of plans to return to school later in the same payment period or term, CU considers the student to have withdrawn and begins the R2T4 process immediately. However, if the student does return to CU in the same term, even if he/she did not provide written confirmation of plans to do so, the student is not considered to have withdrawn and is eligible to receive the Title IV funds for which the student was eligible before ceasing attendance. Financial Aid will then reverse the R2T4 process and provide additional funds that the student is eligible to receive at the time of return.

Institutional funds are not subject to the R2T4 policy. Return of Kentucky State funding are governed by Kentucky Higher Education Assistance Authority.

Determining the Withdrawal Date:

For an official withdrawal, the effective withdrawal date is the first date of notification by the student to the Academic Affairs Office or designated official. We may use a last date of attendance for the effective withdrawal date if the last date a student attended class or submitted coursework is verified by an employee at CU who has knowledge of a student's class attendance, or if there is an emergency situation and there is third party documentation that verifies a student has not attended class. For unofficial withdrawal, it is the date the institution becomes aware that the student is no longer attending the institution.

For an unofficial withdrawal, due to the student failing all classes, the effective withdrawal date is the midpoint of the term if there is no late date of attendance reported by instructors. The withdrawal date for students who are academically dismissed is the date of the notification of their dismissal. We may use a last date of attendance for the effective withdrawal date if the last date a student attended class or submitted coursework is verified by an employee at CU who has knowledge of a student's class attendance, or if there is an emergency situation and there is third party documentation that verifies a student has not attended class.

The Return of Title IV Funds:

Step 1: Student's Title IV Information

Financial Aid Office will determine:

- The total amount of Title IV aid disbursed (if any) for the term the student withdrew. (Title IV aid is counted as aid disbursed in the calculation if it has been applied to the student account on or before the date the student withdrew.)

- The total amount of Title IV aid disbursed, plus the aid that could have disbursed (if any) for the term in which the student withdrew.

Step 2: Percentage of Aid Earned

Financial Aid Office will calculate the percentage of aid earned as follows:

The number of calendar days completed by the student divided by the total number of calendar days in the term (weekends included) in which the student withdrew.

Days Attended / Days in Enrollment Period = Percentage Completed

If the calculated percentage exceeds 60%, then you have “earned” all aid for the period and we will not have to return any federal funds.

**Important note: The date the student earns more than 60% of aid does not coincide with the tuition refund schedule for dropped classes, and is only used to determine the amount of financial aid we must return (if any).

Step 3: Amount of Aid Earned by Student

The Financial Aid Office will calculate the amount of aid earned as follows:

The percentage of Title IV aid earned (step 2) multiplied by the total amount of Title IV aid disbursed or that could have disbursed for the term in which the student withdrew (Step 1).

Total Aid Disbursed x Percentage Completed = Earned Aid

Step 4: Amount of Title IV Aid to be Disbursed or Returned

- If the aid already disbursed equals the earned aid, no further action is required.

- If the aid already disbursed is greater than the earned aid, the difference must be returned to the appropriate Title IV aid program. This means that a balance may be created on the student account, and the student will then be billed and responsible for paying all charges. Total Disbursed Aid - Earned Aid = Unearned Aid to be Returned

- If the aid already disbursed is less than the earned aid, Financial Aid will calculate a post-withdrawal disbursement. If this post-withdrawal disbursement contains loan funds, the student may elect to decline these funds as to not incur additional debt. The student will be notified of any additional disbursements via email to their student account.

When students fail to attend their classes, they could leave the University owing money because their charges for tuition, fees, housing and their meal plan exceed the amount of financial aid that they have earned. For these reasons, students are strongly advised to meet with a member of the Financial Aid Office to discuss the financial consequences of dropping out of or withdrawing before doing so.

Determination of Aid for Students who Fail to Earn a Passing Grade in Any Class:

Financial aid is awarded under the assumption that the student will attend for the entire term for which federal assistance was disbursed. When the student has failed to earn a passing grade in at least one class for the term, federal regulations require the school to determine whether the student established eligibility for funds disbursed by attending at least one class or participating in any CU academic-related activity. If the school cannot verify that the student attended CU, all financial aid must be repaid to the federal programs. The student's account will be charged and the student will be responsible for any balance due.

If the student can prove to have participated in a class or academic-related activity past the 60% date, the student will not be required to return any disbursed financial aid. The student's account will be updated and the student will be responsible for any other charges that may have been applied to their account.

Students who are able to verify attendance beyond University records may submit supporting documentation to the Financial Aid Office.

Order of Funds Returned:

The order of return of funds is prescribed by the Department of Education regulations as follows:

- Unsubsidized Federal Direct Loan

- Subsidized Federal Direct Loan

- Federal Perkins Loan

- Federal Direct Graduate PLUS Loan

- Federal Direct Parent PLUS Loan

- Federal Pell Grant

- Federal Supplemental Educational Opportunity Grant (SEOG)

Loans: Loans must be repaid by the loan borrower as outlined in the terms of the borrower's promissory note.

The grace period for loan repayments for Federal Unsubsidized and Subsidized Direct Loans and Federal Perkins Loans will begin on the day of the withdrawal from the University. The student should contact the servicer if he/she has questions regarding the grace period or repayment status.

Students should be aware that all federally funded Title IV programs are administered according to specific program guidelines and regulations. A student's eligibility for future federal financial aid can be adversely affected by dropping classes and withdrawing from the University after financial aid funds have been disbursed based upon a particular enrollment status. This is particularly true for the grant programs which have limitations placed upon the number of semesters assistance can be received.

The completion of registration contractually obligates the student and his/her benefactors to pay all his/her tuition and fees for the entire semester. However, the University has established a withdrawal and refund policy so that the University and student may share the loss equitably when it is necessary for a student to withdraw. In addition to using our institutional refund calculation, students receiving Title IV aid will have a pro-rata or federal refund calculation completed. The calculation that gives the student the greatest refund will be used.